Authored by – Jason Ling

Despite an industry-wide recognition of the transformative potential of data analytics, the insurance sector continues to grapple with substantial challenges stemming from its underutilization. 1Capgemini’s “2024 Global Insurance Executives” survey found 54% of executives said insufficient access to data was a top challenge and this highlights the industry’s struggle to translate data into actionable insights, with advanced data analytics maturity achieved by a limited fraction of insurers. These findings underscore a compelling problem: the stagnation of analytical advancements in the insurance realm, resulting in untapped potential and inadequate responsiveness to rapidly evolving customer expectations, operational demands, and market dynamics. Addressing this problem necessitates a concerted effort to bridge the gap between data collection and actionable insights, enabling insurers to unlock the full potential of analytics and thereby bolster risk assessment, customer satisfaction, innovation, and operational efficiency.

This blog outlines a starter pack of focused insights tailored to meet the unique needs of property casualty insurance. It provides a roadmap for successful integration and utilization to better answer the question, “What has happened?”

The Role of Analytics

Property casualty insurance companies face escalating challenges linked to risk assessment, operational efficiency, and overall customer satisfaction in a rapidly evolving landscape. Analytics has emerged as a powerful tool, facilitating data-driven decision-making to navigate these challenges effectively. Analytics amalgamate intricate data streams into visually comprehensible displays, delivering real-time insights that empower stakeholders with actionable information. These insights provide a consolidated view of the insurance landscape, enabling informed decisions throughout the organization.

Customization for Enhanced Value

While off-the-shelf analytics solutions exist, a tailored approach is imperative to meet the unique demands of property casualty insurance. Custom development, visualizations, and tools enable companies to align analytics with their specific business goals, ensuring pertinent data is presented to relevant users in a timely manner.

Starter Pack of Focused Insights

We’ve developed a starter pack of pre-designed insights that cater to the core requirements of property casualty insurance companies:

- Risk Assessment: This subject area is dedicated to helping underwriters and risk managers better understand the risk characteristics of their portfolios. The user will discover insights into the distributions of key metrics such as TIV, Location Count, and Inforce Premium across key characteristics such as TIV Range, Construction Type, Occupancy, Building Age, etc. These insights can enable users to understand how their book changes over time and identify risks outside of guidelines.

- Claims Management: Efficient claims processing is critical for customer satisfaction. These insights focus on operational metrics for claims leaders to monitor their teams’ performance. The tool consolidates data on claim volume, processing times, and outcomes. Adjusters and leaders can promptly identify trends, expedite claims, and optimize the entire claims lifecycle.

- Claims Monitoring: Monitoring claim trends is key to ensuring profitability for any insurance company. This workbook provides insights into key metrics such as claim count, incurred loss, and average severity. It allows users to slice and dice by their key characteristics, such as loss date, line of business, loss location, loss cause, etc. Business users can compare against prior years to identify trends, monitor performance, and take action.

- Underwriting Operational Efficiency: Streamlining internal processes is pivotal for cost reduction and enhanced efficiency. This subject area tracks operational metrics like underwriter productivity, underwriter open work, and straight-through processing, enabling management to pinpoint bottlenecks and areas for enhancement.

- Financial Performance: Given insurance’s inherently financial nature, users need insights into written, earned, and inforce premium and incurred loss ratios. Finance, Sales, and Underwriting teams can formulate strategies based on real-time financial data.

- New Business & Renewal Insights: Understanding new business and renewal is key to meeting financial and strategic goals for insurance companies. The new business tool helps business users understand who, what, and where your new business is coming from. Enabling businesses to confirm the business they are writing is what they intend and track agency performance. The renewal insights focus on the retention of existing businesses. Monitoring retention rates for an insurance company is vital as it reflects customer satisfaction and loyalty, reduces acquisition costs, and sustains stable revenue streams.

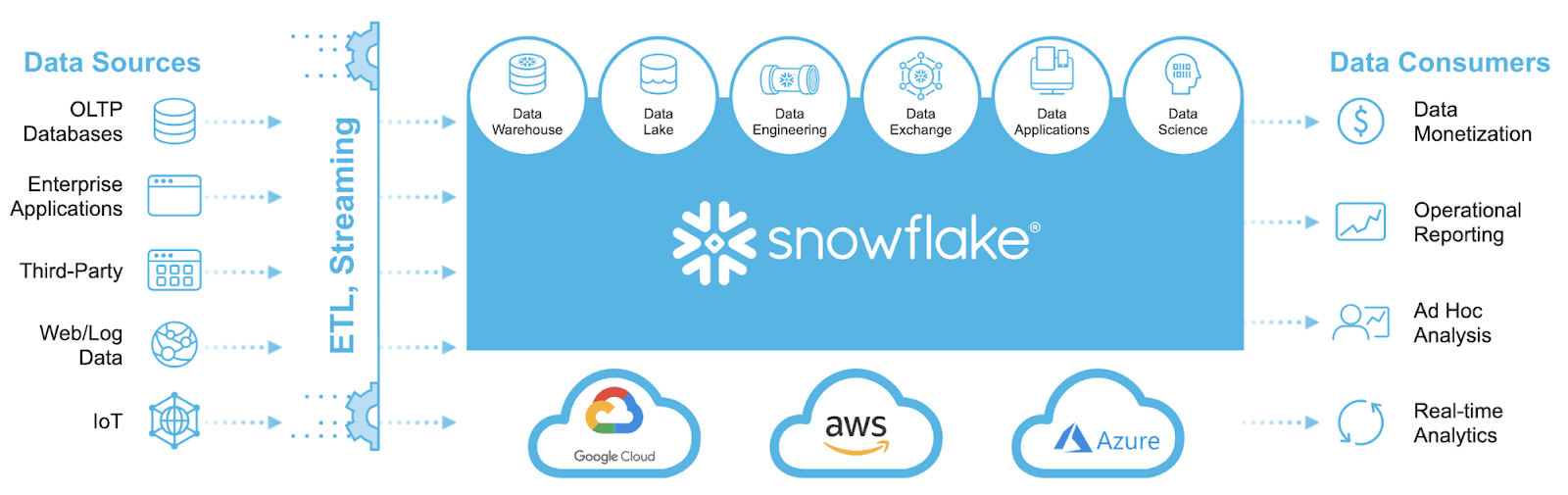

- Implementation Process: The implementation journey commences with a comprehensive evaluation of the insurance company’s existing data infrastructure and business requirements. Leveraging the capabilities of Snowflake, our analytics experts work closely with the insurance provider to design an agile data architecture that ensures efficient data integration, storage, and accessibility.

Snowflake’s architecture is engineered to handle the intricacies of modern data management, enabling seamless integration of various data sources, both structured and semi-structured. This agile architecture facilitates rapid data ingestion, transformation, and preparation, providing a solid groundwork for responsive analytics. The team follows an agile software development life cycle approach to define, develop, and deliver the tools.

Shaping the Future of Property Casualty Insurance

Analytics tools are at the forefront of transforming property casualty insurance, harnessing the potential of data. Utilizing a starter pack of focused insights, insurance companies can extract insights for risk assessment, claims management, operational efficiency, and financial performance. This partnership between property casualty insurance providers and analytics companies marks a significant stride towards a future where data-driven decisions underpin success. By embracing the potential of analytics, property casualty insurance companies are poised to reshape their industry, leading to superior outcomes for customers, stakeholders, and overall profitability.

- https://www.capgemini.com/insights/research-library/world-property-and-casualty-insurance-report/

↩︎