Authored by – Jason Ling

Business Challenge

Insurance companies continuously grapple with the complexities of managing aggregation and concentrations of risk. These challenges are particularly pronounced when it comes to the accumulation of policies in specific geographic areas, navigating intricate policy terms, and preparing for the potential impact of catastrophic events that could lead to extensive losses. Effective risk management in this domain necessitates a robust approach to accurately assessing and pricing risks, making strategic use of reinsurance, and leveraging data analytics to identify trends and correlations that could influence decision-making.

The Innovative Solution

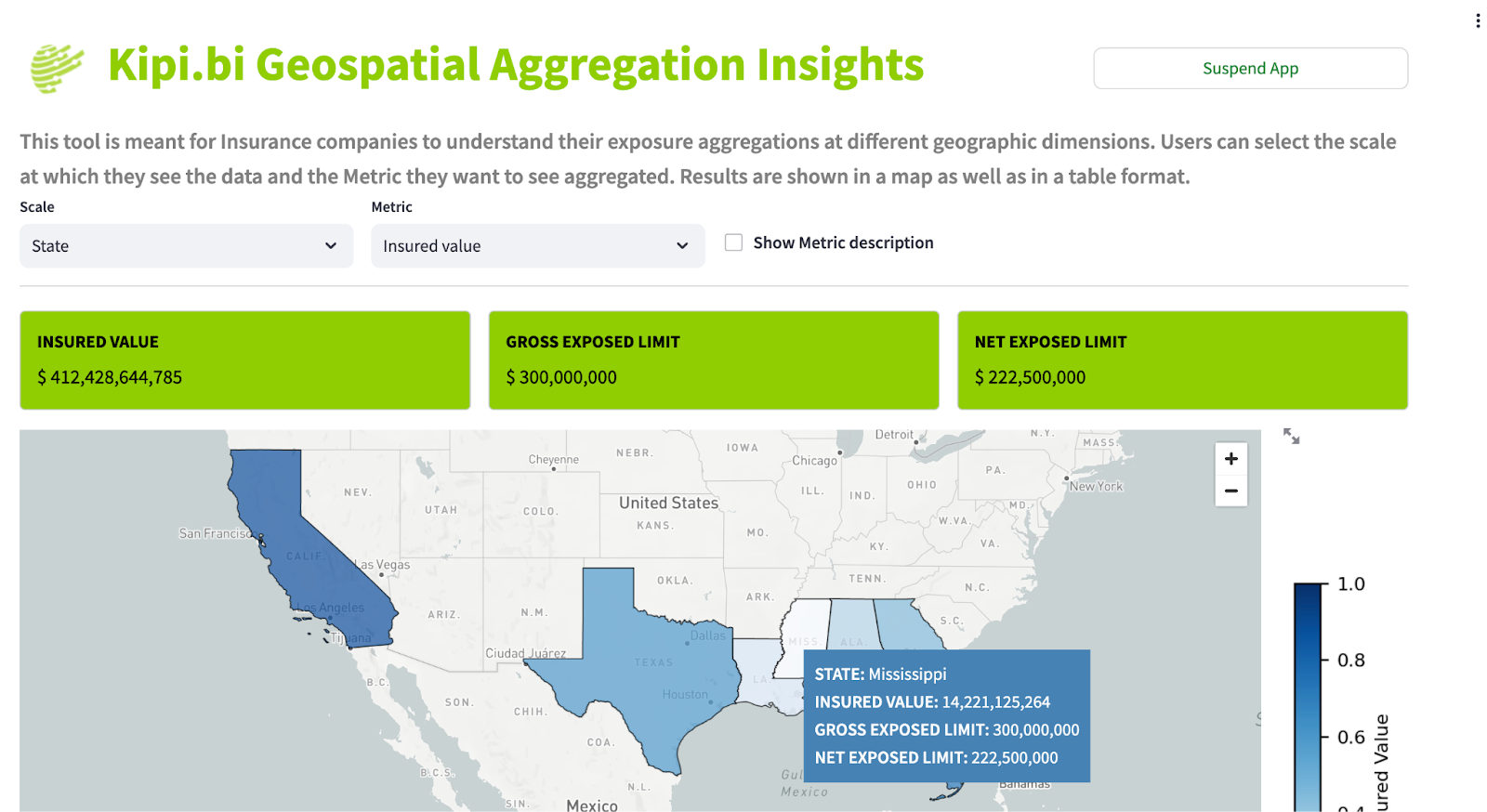

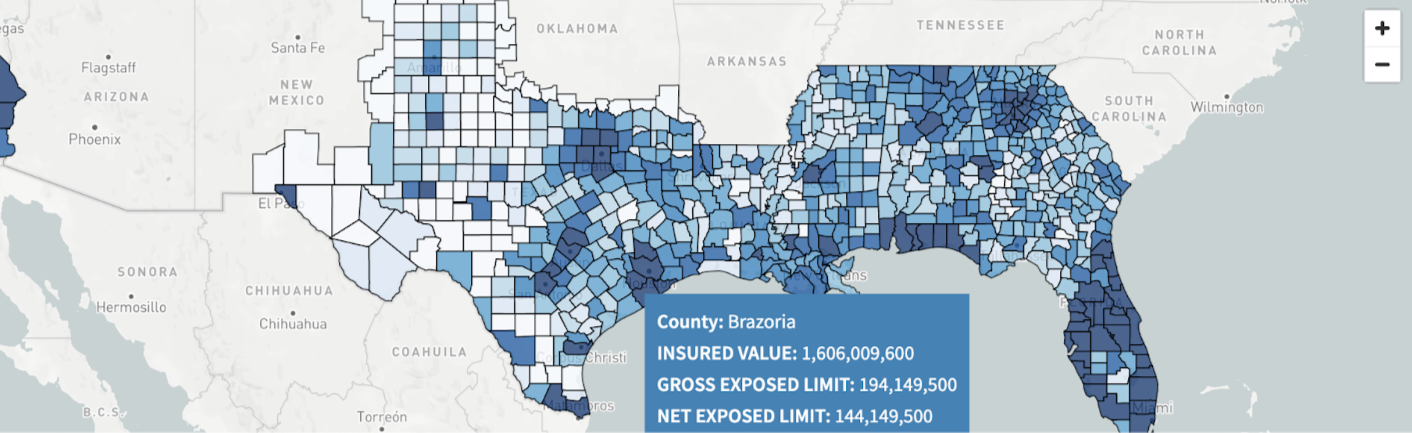

Enter Snowflake, a cloud-based data platform designed to handle and analyze vast amounts of geospatial data with remarkable efficiency. By integrating Snowflake with a custom-built geospatial application using Streamlit, insurers gain a powerful tool to visualize and manage risk exposures in real-time. This integration allows insurance companies to:

- Visualize Risk Exposures: Insurers can see a clear, real-time picture of where their policies are concentrated and how risk is distributed across different geographic areas.

- Identify High-Risk Areas: The ability to pinpoint areas with high concentrations of risk is crucial. This insight helps in understanding and mitigating potential vulnerabilities.

- Optimize Underwriting and Reinsurance Strategies: By analyzing risk from various financial perspectives—such as ground up, gross, and net — insurers can make more informed decisions regarding underwriting and reinsurance.

- Enhance Capital Allocation: Better data and visualization lead to more strategic capital allocation, ensuring resources are directed where they are most needed.

Impact of the Solution

The implementation of this solution significantly enhances an insurer’s ability to proactively manage risk. The improved visibility into risk aggregation and concentrations allows for better-informed decisions, leading to enhanced financial resilience. By harnessing the power of real-time data and sophisticated geospatial analysis, insurers are better equipped to handle the complexities of modern risk management.

Typical Aggregation Pain Points

Despite advancements in technology, insurance companies still face significant pain points when managing aggregation and concentrations of risk. These challenges often stem from the limitations of traditional tools and processes, which can hinder effective risk management. Some of the most common pain points include:

Complex Policy Terms

One of the biggest hurdles in managing risk aggregation is dealing with complex policy terms. Insurers often have to aggregate policies that include various intricate details such as:

- Attachment Points: The specific dollar amount at which insurance coverage begins.

- Participation Percentages: The portion of risk or premiums that different parties share.

- Peril Limits: The maximum amount an insurer will pay for a particular peril.

- Policy Limits: The overall cap on the amount an insurer will pay for covered losses.

- Reinsurance Limits: The limits set by reinsurance agreements that can further complicate risk calculations.

Traditional business intelligence (BI) tools struggle to handle these complexities effectively, often leading to inaccurate risk assessments and pricing.

Delayed Data Extracts

Timeliness of data is crucial for effective risk management. However, many insurers rely on inforce portfolio extracts that are only pulled on a monthly or quarterly basis. This delay can result in outdated information, making it difficult to respond to emerging risks and trends promptly. Real-time data access is essential for making proactive and informed decisions.

What Does Kipi.ai Offer?

Kipi.ai delivers a cutting-edge solution designed to address the typical pain points faced by insurance companies in managing risk aggregation. Here’s a closer look at what Kipi.ai brings to the table:

Simple, Reliable, and Custom Solution

Kipi.ai offers a solution that is both straightforward and dependable, tailored specifically to meet the unique needs of each insurance company. Key features include:

- Capable of Handling Millions of Records: Snowflake’s robust infrastructure can efficiently manage and process vast amounts of data, ensuring comprehensive risk analysis.

- Customized to Your Needs: The solution is fully customizable, allowing insurers to adapt the system to their specific requirements and policy terms without compromising on performance or accuracy.

No Licensing Fees

Unlike many traditional products that come with recurring licensing fees, Kipi.ai provides a cost-effective alternative. This eliminates the financial burden of ongoing fees, making it an attractive option for insurers of all sizes.

Built on the Snowflake Ecosystem

Kipi.ai leverages the powerful capabilities of the Snowflake ecosystem to deliver an efficient and scalable solution. Key features include:

- Automated Ingestion of New Data: The system automatically ingests new data, ensuring that insurers always have the most up-to-date information for their risk assessments.

- Fast & Scalable Processing with Snowpark: Utilizing Snowpark’s multi-threaded processing capabilities, Kipi.ai ensures rapid data processing and analysis, even with large datasets.

- Custom Streamlit App: Insurers can access a custom-built Streamlit application via a web browser, with seamless Snowflake authentication, providing a user-friendly and secure interface for data analysis and visualization.

- No External Data Transfer: All data processing occurs within the Snowflake ecosystem, ensuring data security and compliance with regulatory requirements by avoiding external data transfers.

Technical & Domain Expertise

Kipi.ai brings a wealth of technical and domain expertise to its solution, ensuring optimal performance and tailored functionality. Key areas of expertise include:

- Snowflake Optimization: Expert knowledge in optimizing Snowflake environments to ensure efficient data processing and storage.

- Aggregation Analysis and Tool Development: Specialized in developing tools and methodologies for accurate aggregation analysis, tailored to the specific needs of the insurance industry.

- P&C Insurance: Extensive experience in Property & Casualty (P&C) insurance, ensuring that the solution meets the unique demands and regulatory requirements of this sector.

Conclusion

Kipi.ai stands out as a comprehensive solution for insurers looking to improve their risk aggregation management. By offering a customizable, reliable platform built on the Snowflake ecosystem, Kipi.ai addresses the critical pain points faced by the industry. Its combination of advanced technical capabilities and deep domain expertise ensures that insurers can manage their risks more effectively, enhancing their overall financial resilience. Reach out today if you’re interested in learning more!