Introduction

In today’s fast-paced financial environment, efficiency and accuracy are paramount. Underwriters, responsible for assessing risk and determining the terms of loans and insurance policies, often rely on extensive guidelines to make informed decisions. However, navigating these comprehensive documents can be time-consuming and prone to human error. To mimic what we can implement with customers, we developed an AI Assistant using Snowflake Cortex, leveraging the Property and Liability Insurance section of Fannie Mae’s Multifamily Selling and Servicing Guide as the underwriting guidelines. This solution is designed to streamline the underwriting process, offering substantial benefits to insurance carriers and brokers.

The Challenge: Navigating Complex Underwriting Guidelines

Underwriting involves scrutinizing numerous factors, from financial health to property evaluations. These assessments are guided by detailed and often lengthy documents. Large carriers and brokers have to deal with guidelines by state and by product. The sheer volume and complexity of these guidelines can overwhelm even experienced underwriters, leading to delays and inconsistencies in decision-making.

Common Issues Faced by Underwriters:

- Time-Consuming Research: Manually searching through guidelines for relevant information.

- Inconsistencies in Interpretation: Varied understanding and application of guidelines.

- Human Error: Risk of overlooking critical details.

The Solution: An AI Assistant Powered by Snowflake Cortex

Our AI Assistant addresses these challenges head-on by leveraging the power of Snowflake Cortex. This cutting-edge solution provides underwriters with quick and precise answers to their queries, based on the underwriting guidelines. Let’s delve into how this AI Assistant works and the advantages it offers.

How It Works

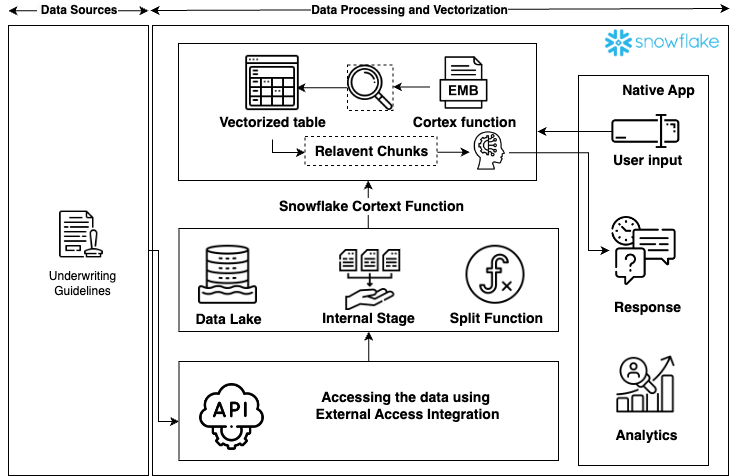

- Data Integration with Snowflake Cortex:

The underwriting guidelines are ingested into Snowflake, where it is structured and indexed for efficient querying. Snowflake Cortex provides the robust data management and processing capabilities necessary for handling such a comprehensive document.

- Natural Language Processing (NLP):

The AI Assistant uses advanced NLP algorithms to understand and interpret the underwriter’s questions. This allows the system to parse complex queries and extract the most relevant information from the guidelines.

- Interactive Query Interface:

Underwriters interact with the AI Assistant through a user-friendly interface. They can type in their questions in natural language, and the AI Assistant retrieves precise answers in real-time.

- Continuous Learning and Improvement:

The AI Assistant is designed to learn from its interactions. Over time, it becomes more adept at understanding nuanced questions and providing even more accurate responses.

Key Features

- Quick Access to Information: Instantly retrieve relevant sections of the guidelines, significantly reducing research time.

- Data Security & Privacy: Training occurs entirely within the end user’s environment, ensuring that data is never shared externally during the training process.

- Consistency and Accuracy: Ensures uniform interpretation of guidelines, minimizing the risk of errors.

- User-Friendly Interface: Simplifies the querying process, making it accessible to all underwriters, regardless of their technical proficiency.

Benefits for Insurance Carriers and Brokers

The introduction of our AI Assistant offers transformative potential for insurance carriers and brokers. Here’s how:

- Enhanced Efficiency

By automating the retrieval of guideline information, the AI Assistant drastically cuts down the time underwriters spend searching for answers. This efficiency allows them to process more applications in less time, boosting overall productivity.

- Improved Accuracy and Consistency

With the AI Assistant, underwriters receive consistent and accurate interpretations of the guidelines. This uniformity reduces the likelihood of errors and discrepancies, leading to more reliable underwriting decisions and better risk management.

- Competitive Advantage

Insurance carriers and brokers who adopt this AI-powered solution can differentiate themselves in the market. They can offer faster service to their clients, respond more quickly to changes in guidelines, and provide a higher level of accuracy in their underwriting processes.

- Cost Savings

By streamlining the underwriting process, the AI Assistant can lead to significant cost savings. Reduced manual research time, fewer errors, and the ability to handle more applications without additional staff all contribute to a more cost-effective operation.

- Enhanced Underwriter Satisfaction

Reducing the tedious aspects of the underwriting process allows underwriters to focus on more strategic and value-added activities. This not only enhances job satisfaction but also attracts and retains top talent in the industry.

Case Study: Implementing the AI Assistant

To illustrate the impact of our AI Assistant, let’s consider a hypothetical case study:

Background

A mid-sized insurance carrier, “Optima Insure,” faced challenges with their underwriting process. Their underwriters spent an average of 25% of their time searching through their underwriting guidelines to answer questions. This inefficiency led to delays and occasional errors in underwriting decisions.

Implementation

Optima Insure decided to integrate an AI Assistant into their underwriting workflow. The implementation process involved:

- Ingesting the underwriting guidelines into Snowflake Cortex.

- Training the AI Assistant on the specific queries and terminology used by Optima Insure’s underwriters.

- Rolling out the user interface to the underwriting team, accompanied by training sessions.

Results

Within three months, Optima Insure observed the following improvements:

- Time Savings: The time spent on guideline research is reduced by 70%.

- Increased Productivity: Underwriters processed 10% more applications per week.

- Error Reduction: The consistency and accuracy of guideline interpretation improved, leading to a 15% reduction in underwriting errors.

- Positive Feedback: Underwriters reported higher job satisfaction and confidence in their decisions.

Conclusion

Our AI Assistant, powered by Snowflake Cortex, represents a significant leap forward in the underwriting process. By providing quick, accurate, and consistent answers based on comprehensive guidelines, it enhances efficiency, reduces errors, and offers a competitive edge to insurance carriers and brokers. As the financial industry continues to evolve, embracing such innovative solutions will be key to staying ahead of the curve and delivering exceptional value to clients.

Invest in the future of underwriting with our AI Assistant and transform your operations today. For more information, contact us and schedule a demo to see how this solution can benefit your organization.