Unifying 40 Independent data systems for advanced dashboard reporting

Introduction

The 2020 pandemic catalyzed businesses around the globe.

Industries that had relied on conventional business strategies were forced to rapidly adopt

new technologies and new processes. Organizations that were able to quickly pivot and innovate thrived, while others struggled. In the financial services industry, this was particularly acute; embracing digital advancements was a catalyst for success.

Founded 115 years ago with a mission to provide customers with excellent service and care for their assets, Fidelity Bank, headquartered in North Carolina, knew they needed to embrace change. Their Right By You tagline is rooted in their commitment to do good by their customers, be there when needed, offer sound financial advice, and create systems for long-term wealth and health for the Fidelity family.

To maintain that commitment, they needed transformation. Fortunately, the Paycheck Protection Program (PPP) served as a catalyst for Fidelity Bank, providing the critical resources needed to propel its technological and data infrastructure forward rapidly. The PPP’s popularity with small business owners across the United States sparked a transformative phase for the bank, positioning it as a key player in data-driven banking services. Case-in-point: after a few months of working the program as a trusted lender, Fidelity Bank doubled in size.

To compete with larger banks, and continue to deliver the level of service customers expected, the technical infrastructure needed to be improved. To begin this digital transformation, Fidelity knew their most critical asset was data.

Customer Background

Fidelity relied on outdated on-premise Microsoft SQL servers to house their customers’ data, utilizing a combination of Progress OpenEdge, Files, and MS SQL. Microsoft Reporting Services was used for generating business-focused reports, but the data in SQL was not well-modeled for reporting. Fidelity’s leadership realized their legacy data systems were obsolete and becoming an increasingly large liability for their customers and their business.

Approach

Fidelity Bank wanted to unify different data into a single architecture, enabling better analytics for the operational and strategic users. Their goal was to build a data platform that generates operational reports with a 360-degree view of bank customer data. Fidelity leadership chose Snowflake to remedy their aging databases and act as their new home within the cloud. Snowflake then introduced Kipi.ai (2023 Growth Partner of the Year) to lead the migration; strategy, project road mapping, and delivery.

Solutions

The Kipi team successfully transferred all Fidelity data over to Snowflake and unified 40+ source systems for Fidelity’s banking operations. Additionally, Kipi recommended and subsequently integrated Sigma to work as Fidelity’s new reporting tool while adding security protocols to protect the data. This was imperative; all of Fidelity’s operational data would be transferred into Snowflake. The new system brings in transactional data and optimizes the platform by building a unified warehouse that serves as a single source for enterprise analytics across all LOBs.

Fidelity management could now build actionable insights for their sales and marketing teams, insights that drew directly from accurate, up-to date data about their customers. Bank employees and tellers had access to a complete view of their customer profiles, helping them make their promotional efforts more effective and resonate with customers.

Let’s take a look at Fidelity’s House Holding report, which is internally regarded as Fidelity’s most valuable reporting tool created to date.

Originating as a way for Fidelity data engineers to play around with their new visualization tool Sigma, the House Holding report quickly developed into a dashboard that showcases previously untapped customer insights. This customer data now runs through the reporting tool and gets reorganized into a dashboard that bank employees leverage during their decision making, but originally the process was manual and limited. Kipi then stepped in to polish things up and turned around a fully automated tool with added queries, improved design, and a historical data log within a week.

The report successfully consolidated, normalized, and visualized the data so bankers could understand and analyze it more efficiently. Customer-centric decisions are made quicker, and more accurately, and subsequently, the bank can add more value.

Identifying Problems & Delivering Efficient Solutions

| Problem | Solution |

| Fidelity noticed some data incongruencies during early testing periods and started doubting the Snowflake systems in place | The Kipi team figured out that Fidelity’s on-premise system caused the issues, not Snowflake. Although a false alarm, Fidelity was impressed by Kipi’s response and earned additional trust in the partnership |

| Fidelity staff was forced to input data and run reports manually while lacking robust filtering within their House Holding report | Kipi automated the data feed into the Sigma dashboard and added historical data to better complete customer profiles and aid comparative queries |

| Fidelity required data inputs from 40+ independent sources and needed to normalize it all into Snowflake | Kipi conducted extensive testing, analysis, and data monitoring to make sure all data was compliant before entering Snowflake |

| Fidelity had an old credit-debit ledger reporting system that was easily confused | Kipi unified the account hierarchy with Ragged AH, serving all internal purposes |

| Fidelity wanted to build a custom application to catch fraud | Kipi’s solutions team encouraged an out of the box approach to help provide systems insurance with lower cost, fewer code breaks, and less required maintenance than a custom built application solution. |

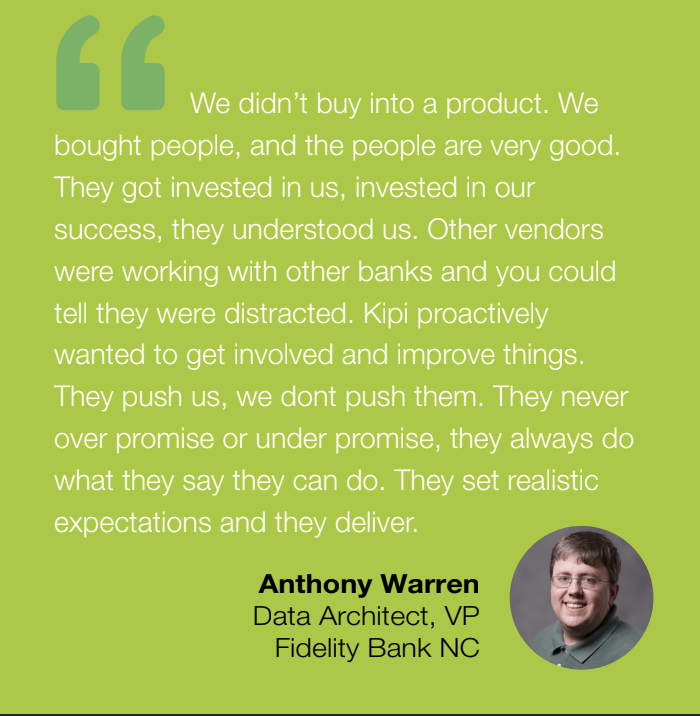

| Fidelity had steadfast concerns over the data cloud and was hesitant to begin the partnership with Kipi + Snowflake | Kipi earned trust and reversed Fidelity’s perspective to become their data agency of record thanks to – High level of communication – Snowflake expertise – No overpromising or underpromising – Turnaround mindset |

Technologies

- Snowflake

- Sigma

- DBT Cloud

- Airflow

- SQLDBM

- Kipi’s Caribou Accelerator

- Python

- SQL

- Kipi’s Watchkeeper Accelerator

About kipi.ai

About kipi.ai

kipi.ai helps businesses overcome data gaps and deliver rapid insights at scale.

With Snowflake at our core, we believe good data has the power to enable innovation without limits, helping you say goodbye to complex data solutions and hello to the modern world of cloud elasticity.

Kipi earned Snowflake’s Americas System Integrator Growth Partner of the Year Award at the 2023 Snowflake Summit and holds 7 industry competency badges.

Kipi is committed to pioneering world-class data solutions for Snowflake customers including 50+ Accelerators, Enablers, Solutions, and Native Apps to boost performance within Snowflake.

Let kipi.ai become your trusted partner for data and analytics and we’ll empower your teams to access data-driven insights and unlock new revenue streams at scale.